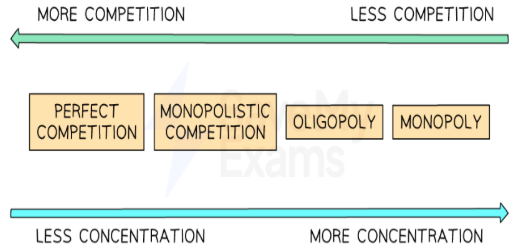

Market structures

-

Market structures are based on the

-

Number of buyers

-

Number of firms

-

Products are different or homogenous

-

Barriers to entry/exit

-

Size of firms

-

Competition; Perfect/Imperfect, Perfect competition is when no individual seller can influence the price of goods due to the immense competition; Street vendors have perfect competition

-

Imperfect is when firms can influence market prices, These include Oligopoly, Monopoly.

Market power

-

Market power is the ability of a firm to influence the market in a way so they are able to control price, output and other variables. Due to this prices can be set above equilibrium.

-

The market power of a firm can be measured using its market share, concentration ratios[ the combined market share of the largest firms in a particular industry] and the barriers to entry[conditions that influence the difficulty for new firms to enter the market and compete with the existing suppliers]

-

In imperfect competition market power may be abused leading to market failure

-

The market failures are, firms being able gto increase barriers to entry so they can reduce suppliers and influence price themselves, lack of innovation and efficiency.

Concentration Ratio

-

A high concentration ratio means few firms dominate the market [Monopolies, Oligopolies can exist]. Viceversa [Monopolies, Oligopolies can not exist.]

-

More market competition=Less market power

-

Most common concentration ratio; CR4 and CR8 and CR10, ratios of top 4,8 and 10 firms respectively

Perfect competition; No barriers to entry/exit, homogenous products, perfect information.

Monopolistic competition; Low barriers to entry/exit, Slightly different[differentiated] products, imperfect/asymmetric information

Credits to SaveMyExams

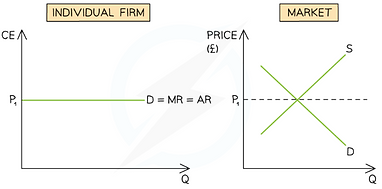

Perfectly competitive Markets

-

Many buyers and sellers

-

No barriers to entry/exit, homogenous products, perfect information

-

P=MR[Marginal revenue;Additional revenue made by 1 unit of product]=AR[Average revenue]

-

Firm is selling at market price as it is a price taker; Can’t influence the price in market and have no market power]

-

The firm doesn’t make supernormal profits at its profit maximisation level of output [MC;Marginal cost=MR]

-

It is also most efficient as MC=AC[Average cost] and AR=MC; which shows allocative efficiency[resources used optimally]

-

As the firm is not making supernormal profits it is unlikely to make many innovations as it can’t reinvest into the market.

Credits to SaveMyExams

-

Credits to SaveMyExams

Imperfectly Competitive market

-

Many buyers however;Many sellers if monopolistic,Few sellers if oligopoly,One seller if monopoly

-

Products are differentiated[monopolistic], Differentiated(Food) or Homogeneous(Petrol)[Oligopoly], Unique if Monopoly.

-

Consumer choice/Number of firms; Relatively High if monopolistic, low if oligopoly or monopoly[ monopoly is lowest] The highest is in perfectly competitive

-

Market power and price taker/maker; Low market power in monopolistic, high in oligopoly and monopoly[highest in monopoly]

-

Low barriers to entry[monopolistic], high barriers to entry in oligopoly, very high barriers to entry in monopoly

-

High efficiency in monopolistic, low in oligopoly and sometimes no/inefficient in monopoly

-

Profits are normal but can be abnormal in short run in monopolistic, supernormal in oligopoly and monopoly

-

Low market power[monopolistic], high market power[ oligopoly ] and Full market power in monopoly

-

PED for goods is elastic in monopolistic, relatively inelastic in oligopoly and very inelastic[nearly perfectly inelastic] in monopoly

Credits to SaveMyExams

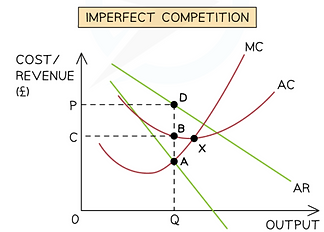

Analysis

-

The MR and AR are downward sloping as firms must lower prices to sell more goods

-

MR is steeper; as output increases, price of all goods in the market must decrease not only the additional unit.

-

Hence firm is price maker

-

Price is also above the costs[C] hence the firm undergoes supernormal profits that can be reinvested into the market to innovate.

-

It is also productively inefficient as MC<AC hence firm could be making more products, and is not producing at a socially optimum level

-

It is also allocatively inefficient as AR>MC and it could make more without incurring losses. It is not producing at socially optimal level

-

It is due to these inefficiencies that these firms can undergo supernormal profits

Profit Maximisation

-

There are explicit and implicit costs

-

Explicit costs are the costs that have to be paid for, like rent, wages, etc.

-

Implicit costs are non monetary opportunity costs of doing something, both must be taken into account to be able to efficiently allocate resources.

-

Profit is Total revenue[TR] - Total costs[TC], for perfectly competitive markets TR=TC and no supernormal profits are made, only breakeven profits. Supernormal profits happen when TR>TC and losses when TC>TR.

-

At output 5 TR=TC and no more profit will be made if more output is produced;Normal profit.

-

Any output below 5 gives supernormal profits and after 5 gives a loss

Profit Maximisation

-

One of the objectives of firms is to maximise profits as this also benefits shareholders as they receive dividends and increase share prices which increase shareholders wealth.

-

Profit maximisation occurs when MR=MC, and not necessarily if mr>mc or tr>tc because they just mean the firm is making more profit than they need to stay in business but they might not be maximising the profit they can earn, this is when mr=mc

-

If mc<mr then more profits can be made by producing more goods, if mc>mr the firm should reduce production as they have gone beyond profit maximisation level

Profit Maximisation

-

However in practice it might be difficult for firms to be at profit maximisation level; first of all they may not know where the level is, and also because costs keep fluctuating daily, however daily price changes can annoy customers, speaking of short term. In the long term it is easier for firms to achieve this level as prices can be adjusted. This level may lead to high prices for consumers. Will also change [TR-TC].

-

Note that TR=TC doesn’t mean maximising profits, only MR=MC does.

-

TR=Total revenue/Units produced

-

TC=Total costs/Units produced

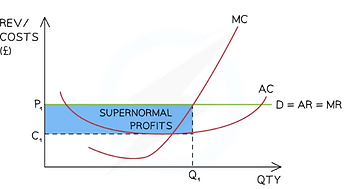

Profit Maximisation

-

The firm has market power as the MR and AR are downward sloping

-

Where MR=MC is the profit maximisation level of production

-

Selling price is P1 and costs are C1 the supernormal profits are (P1-C1)*Q1

-

Credits to SaveMyExams

Profit Maximisation

-

The firm has market power as the MR and AR are downward sloping

-

Where MR=MC is the profit maximisation level of production

-

Selling price is P1 and costs are C1 the supernormal profits are (P1-C1)*Q1

-

Credits to SaveMyExams

Profit Maximisation

-

Profit maximisation occurs at output 3, at 1 and 2 more output should be produced, at 4 lesser output should be produced

-

Firms in perfect competition tend to operate at a profit maximisation level.

Perfect competition

-

Firms in a perfectly competitive market will have little to no market power and little market shares along with low concentration ratios. Due to the high competition that encourages efficiency market failure is minimal, which is the reason governments work to ensure markets have good competition with antitrust laws,etc.

-

Most times firms will be working at a profit maximisation level in perfect competition, as they are price takers and hence must sell at the market price to maximise profits. Price takers due to no market power so MC=MR

-

However in the short run firms can make supernormal profits, this may happen because other firms may leave the market due to low profits and lack of incentive. In this period the supply reduces and prices increase, and other cases as well.

Perfect competition

-

This is the normal market scenario in the long run

-

Credits to SaveMyExams

Perfect competition - Short Run

-

Firm is making supernormal profits [P1-C1]*Q1

-

It is still producing at MC=MR, profit maximisation level, however prices have risen due to external factors and not influence from firms

-

We also notice that the MC of a firm is it supply curve in a perfectly competitive market, because firms will only produce additional goods if the price at least covers the cost of it.

-

Credits to SaveMyExams

Perfect competition

-

This supernormal profit is short lived as firms outside the market are enticed to join it due to the supernormal profits.

-

Remember that there are no barriers to entry so they can exit and enter whenever they want. Hence supply increases and prices reduce back to normal profit levels

-

Credits to SaveMyExams

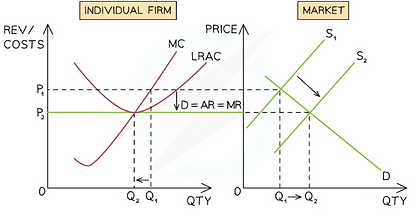

Analysis

-

The firm was producing at profit maximisation level initially and making supernormal profits, seeing this new firms joined the market to have the supernormal profits. Increasing supply, causing price to fall in the market, P1 to P2.

-

Hence as MC at Q1 was not covered by the current P2 price, supply of the firm contracts to Q2.

-

Now firm produces at MC=MR and AR=AC. The profit maximisation level which is also breakeven profits

-

However firms can also make losses in the short run

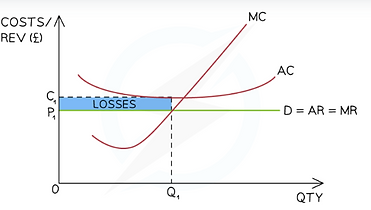

Losses

-

The AC is at C1 however AR is at P1 hence firms are making losses equivalent to (c1-p1)*q1.

-

Even though they are producing at profit maximisation level. As long as they can cover their day-to-day production costs/variable costs they can continue producing and pay back fixed costs later on once they are making normal profits again

-

Credits to SaveMyExams

Loss to Normal profits

-

A firm can continue to produce as noted before if the price can cover they variable costs, if not then they should shut down as there are no barriers so they can exit easily.

Variable costs are those like electricity bills, total wages. Costs that rise proportionally with output

-

Credits to SaveMyExams

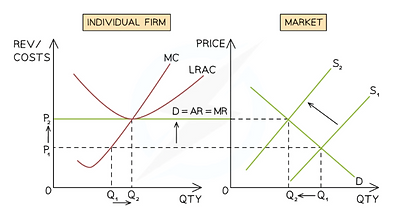

Analysis

-

The original price maximisation level was loss making

-

Due to the losses some firms will leave the market, hence supply decreases, quantity decreases causing prices to rise.

-

The new price P2 allows the firm to extend its supply as it can cover its costs, now AR=AC and breakeven profits are made.

-

Hence in the short run;

-

Firms can make losses, which will be made up when other firms leave the market

-

Or

-

Firms can make supernormal profits, which will be eradicated when new firms enter the market

Efficiency

-

At AR=MC allocative efficiency is maximised such that society's overall welfare is maximized. No one can get more benefit without making the other party worse off. Equilibrium is met.[social welfare linked to producer and consumer surplus]

-

Productive efficiency is met at AC=MC meaning a firm is producing at the lowest possible cost for a given level of output. Hence the firm is using its resources most optimally. As at this point average costs are the lowest

-

Profit maximisation level, MC=MR

-

Productive efficiency, MC=AC

-

Allocative efficiency, AR=MC

Monopolies

-

Monopolies have absolute market power; they are the market as they are the only supplier in it, total market share and perfect concentration ratio.

-

Monopolies tend to have significant market failure, hence governments work to regulate monopolies and intervene so no firm can have more than 25% market share.

-

If the firm has a 100% concentration ratio it is considered a pure monopoly.

-

Characteristics

-

-

High barriers to entry/exit

-

No substitutes/unique product

-

Single seller-also means customer loyalty is high as there are no other firms they can buy from

-

Price maker

-

Usually relatively more inefficient than other competitive markets

-

Supernormal profits

Abnormal profits

-

As a monopoly is the price maker it can theoretically charge any price wanted[ in practice laws are put in place to prevent this]

-

It will also produce at profit maximisation level

-

Supernormal profits= (P1-C1)*Q1

-

Credits to SaveMyExams

Normal profits

-

However it is not necessary that monopolies hike up prices of their products, and instead may settle for the normal profits.

-

This may be because of

-

-

Governmental pressures

-

Social responsibility and public relations

-

High prices are incentive for firms to enter market [still possible for big firms who can overcome barriers to entry]

-

Maximising efficiency rather than profits[ for public image or sustainability ]

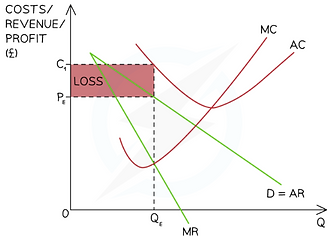

Losses

-

A monopoly can make losses and thus settle to minimise the losses in the short run. This has occurred as P or the AR is below C or MC.

-

Even if the firm is large, it can not sustain losses forever and will have to either leave the industry or change production methods/strategies

-

Leaving can be difficult due to the high barriers to entry and exit. Like costs of specialised equipment, government regulations, long contracts.

-

Credits To SaveMyExams

Comparision

-

As compared to firms in perfectly competitive markets, monopolies tend to be inefficient in both allocation and production.

-

This is due to the lack of incentive to be inefficient; the lack of competition.

-

Monopolies will both likely produce more if they were in competition and try to minimise costs if they were in competition.

-

There is also a lack of innovation due to the same reasons

-

This leads to welfare loss as social surplus reduces, both consumer surplus[high prices] and producer surplus[high costs]

Evaluation

-

Monopolies will have supernormal profits which is great for investing and R&D. They also tend to benefit from significant economies of scale, thereby lowering costs and increasing producer surplus. Can also improve global competitiveness

-

Supernormal profits also lead to relatively high wages.

-

Innovation brings along development in quality of products, the economies of scale can lower prices in the market and from profits of producer subsidies[cross subsidization]

-

Suppliers for the monopoly ca benefit greatly as monopolies often buy in bulk and heir products receive fame if distributed nationally or internationally.

-

However, They tend to be inefficient, and also lack innovation. Even if employees are unhappy, they can’t switch to other firms especially if specialised. Prices are often hiked if no regulations exist, nor is quality of products improved, cross subsidization may lead to high prices as profits are used for other products which may be loss making. This makes inefficiency even more evident as the dominant profit making product can bail out a loss making product.

-

Consumer surplus may decrease

-

Monopolies may exploit their suppliers and the supplier will be none the wiser as it will be anxious to loss a large customer.

These points are a must for any questions on monopolies in Paper 1*

Natural monopoly

-

A natural monopoly is a market structure where a single firm can produce the entire output of the industry at a lower cost than any combination of smaller firms. Often seen in industries with significant economies of scale and when it is beneficial to have one singular firm in control rather than multiple. Example, Railways tend to be natural monopolies, as it is better that one firm maintains them all providing quality control and avoiding duplication of resources. State monopolies tend to be natural monopolies.

-

These economies of scale may also be needed as the costs of operating in the industry at a large scale may be very high. Like sunk cost, example needing specialised equipment in Oil refining.

Natural monopoly

-

A natural monopoly is a market structure where a single firm can produce the entire output of the industry at a lower cost than any combination of smaller firms. Often seen in industries with significant economies of scale and when it is beneficial to have one singular firm in control rather than multiple. Example, Railways tend to be natural monopolies, as it is better that one firm maintains them all providing quality control and avoiding duplication of resources. State monopolies tend to be natural monopolies.

-

These economies of scale may also be needed as the costs of operating in the industry at a large scale may be very high. Like sunk cost, example needing specialised equipment in Oil refining.

Natural monopoly

-

When there is only supplier in the market the demand for that supplier is D1.

-

This much is needed to reimburse the sunken costs of the monopoly. However if another firm enters the market the demand is split and each firm gets demand equal to D2 at which they make losses at every production level, hence it makes more sense to have only one firm controlling the market

-

Credits to SaveMyExams

Oligopolies

-

Firms in oligopolies have significant market power and large market share. The concentration ratio of the top firms will also be very high. Due to these there are possibilities of firms engaging in anti-competitive pricing to drive out smaller/weaker firms from the market, thus governments intervene in such markets also. Keeping firms under 25% market share.

-

If the top 5 firms in the market have more than 60% concentration ratio, it is considered a monopoly.`

-

Characteristics

-

High barriers to entry/exit

-

Few substitutes/differentiated[food] or homogenous goods[oil], brands can be different

-

Few dominant sellers-also means customer loyalty is high as there are not many other firms they can buy from

-

Price maker

-

Usually inefficient

-

Supernormal profits

Collusion

-

Market power encourages the act of collusion when firms agree to hold back supply in the market such that prices are pressured to increase, this is often illegal. The reasons for collisions can be, little to no regulation as there will be no dire consequences. The barriers can also be high so there is low risk for new firms to enter and take away their demand, and subsequently competition would be low. Hence firms won't need to constantly spend on having to ‘one up’ their competitors[can be price cutting or improving products]. Collaborating also brings about economies of scale as costs can be shared such that individual burden is low.

-

However firms will not always have/want to collude as this is illegal in most countries or to increase their own individual market share, by price cutting. Referred to as price wars. However as mentioned earlier price wars can cause loss in profits due to the lower prices encroaching on profit margins.

Collusion

-

The firms who are colluding act as one firm in the market and provide either low quantity of good or low at high prices[if all competitors are in the collusion-which is the case of the diagram]

-

Hence supernormal profits are made

-

They are also producing at profit maximisation level

-

Credits to SaveMyExams

Types of collusion

-

Collusion can be overt [like Phoebus cartel] and tacit [like trade associations].

-

Overt Collusion involves a formal, explicit agreement between firms to coordinate their actions. Hence often there is evidence of such collusion, like agreements/contracts.

-

Examples are, Price fixing, Allocation agreements[firms allocate different sectors of the industry to each firm] and output quotas[firms limit how much each of them can produce therefore limiting supply in the market]

-

Tacit conclusion involves firms coordinating their actions without a formal agreement. Hence evidence is often very hard to find and incriminating firms also proves difficult.

-

Examples are Price leadership[one firm sets the price, others follow suit] and parallel pricing[Firms independently set similar prices].

Interdependence

-

Under Oligopoly, since a few firms hold a significant share in the total output of the industry, decisions of different firms affect every firm greatly hence there is a lot of interdependence.

-

There market power encourages the act of collusion when firms agree to hold back supply in the market such that prices are pressured to increase, this is often illegal.

-

Firms in oligopolies also tend to collaborate[other than colluding] as the economies of scale are much more beneficial than costs of competing with each other, however the possibility of this depends on the leniency of governmental policies.

-

Due to the high degree of interdependence we use the game theory to understand firms decision making.

Game theory

-

Game theory is a mathematical framework used to analyze strategic interactions between rational decision-makers. It provides a way to model situations where the outcome for one player depends on the decisions of others.

-

Concepts of a game theory

-

Players: The individuals or entities involved in the game, here being firms.

-

Strategies: The choices and plane of action available to players

-

Payoffs: The rewards associated with each combination of strategies.

-

Nash Equilibrium: A situation where no player has an incentive to change their strategy, given the strategies of the other players.

-

A common example is the prisoner's dilemma. In which the players[prisoners] are suspect of a bank robbery, and the plan of actions are.

-

Both confess; Each player receives 3 year sentence or Both deny; each player receives 2 year sentence or One confesses; The one who confesses receives 1 year, the other receives 5.

-

Here both parties can collude, such that they receive a relatively lenient sentence of 2 years[both deny]. The Nash equilibrium would be either of them betraying each other as this would give them the best possible outcome[if the other doesn’t confess]

-

Firms can use this to have a better payoff, such is the example of price cutting. Where one , both or none of the firms price cut.

-

If one does, that means it would capture more market share and power. If both do, they will just lose out on profits and have to do continuous price cuts until one party can’t sustain it. Or they can choose not to price cut in unison. This would be the outcome if both firms decided to collude as it would be to both firms interests. A nash equilibrium would be neither firm price cutting, or both of them price cutting.

Other forms of competition

-

Price cutting is a form of price competition. There is also predatory pricing[an anti competitionary policy] where firms attempt to drive out new firms by setting price of goods below market level such that all firms sustain losses; bigger and more established firms can sustain them for longer rather than new smaller firms. Another anti competitionary policy is limit pricing, where prices are limited such that profits are reduced and new firms are disincentivized to join the industry, this reduces competition.

-

Firms can also offer offer vouchers , and rewards for purchases to increase their demand and brand loyalty. They can also sponsor big name players to attract demand from fans and followers to them, like Nike sponsoring Mbappe, LeBron James.

-

Price competition refers to competition primarily by lowering prices, conversely for non price competition the price itself is usually left unchanged.

Monopolistic competition

-

Monopolies and monopolistic markets are very different.

-

The main difference being the substitutes and profits in the long run.

-

There are substitutes available in monopolistic markets and firms have little influence on price hence in long run they make normal profits.

Monopolistic competition - Long Run

-

Even if firms make abnormal profits in short run, these will be reduced as new firms enter the markets as there are low barriers to entry.

-

In the same sense, in the short run if the firms are making losses, some firms will exit and the remaining will start making normal profits

-

Much like what happens in perfectly competitive markets.

-

These firms also operate very efficiently, however not at maximum efficiency due to the extra costs of differentiation of goods, and also due to their market power as they are not required to solely focus on efficiency to improve profits.

-

Credits to SaveMyExams

Monopolistic competition

-

However like perfect competition in the short run abnormal profits can be made due to the same circumstances as in perfectly competitive markets.

-

These firms also tend to produce at profit maximisation level as they have little control over price and thus can’t artificially increase profits substantially.

-

This price setting power is shown in the prior diagram as we see that these firms have some market power due to their products being slightly differentiated and are preferred by different consumers.

-

Hence prices can be increased to an extent to increase profits, and experience supernormal profits.

-

These firms also make losses in short run.

-

This can be due to overspending on advertising, which is needed to differentiate their products and build a specific consumer base. These firms like all may also be working inefficiently which can lead to higher costs than sustainable. Price wars can still occur in these markets, leading to possible losses

Government intervention

-

The methods the government can take to improve competition.

-

As stated multiple times, anti trust laws to prevent firms to take part in anti-competitionary actions that would harm consumers and other parties.

-

Price controls of price ceilings can be used to prevent exploitation of consumers and price flooring to prevent exploitation of suppliers to monopoly/oligopoly. National Minimum wages are also price floors for the labour market as profit maximisation would entail reducing wages which are major costs.

-

Sometimes the government may take over firms that were formerly operating privately, this is often done when these firms provide goods/services nationwide as it creates more equality in opportunity and equity as everyone will have access to the resources provided. However such public firms are often subject to corruption, lack of incentive to be efficient as government can always bail them out for being inefficient and bureaucracy.

-

Conversely firms that take part in anti competitionary policies can be penalised by fines or imprisonment, however these may still be disproportionate to the profits made, especially fines, and ofcourse it is subject to corruption.